What information about my organization is needed?

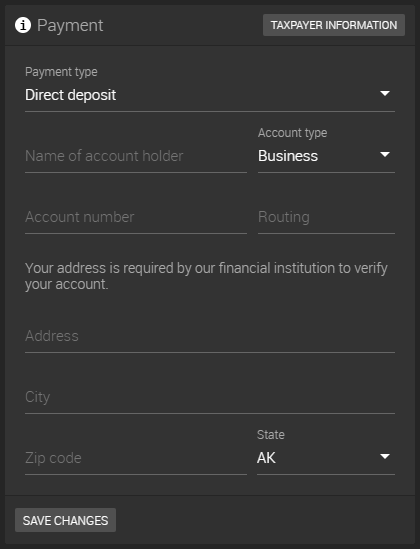

Besides your organization name and contact information, we need additional legal information to process your payouts. More specifically, if you decide to get paid by check, we need the entity you want the check to be payable to. If you decide to get paid by direct deposit, we need your bank account information. In both cases, we need your physical address or physical address of your business.

To update your payment preferences, go to your company profile page from the main menu and enter your payment information in the Settlement settings panel as shown below.

If you get paid $600 or more in a calendar year, you are required by US tax laws to submit your taxpayer information for reporting and you will receive Form 1099-MISC in January of the following calendar year. To submit your taxpayer information, please email us your completed Form W-9, downloadable from the official website of the IRS here. Please note that if you fail to provide your taxpayer information when your payouts exceed $600 in a calendar year, we may withhold future payouts until we receive your Form W-9.